Overview

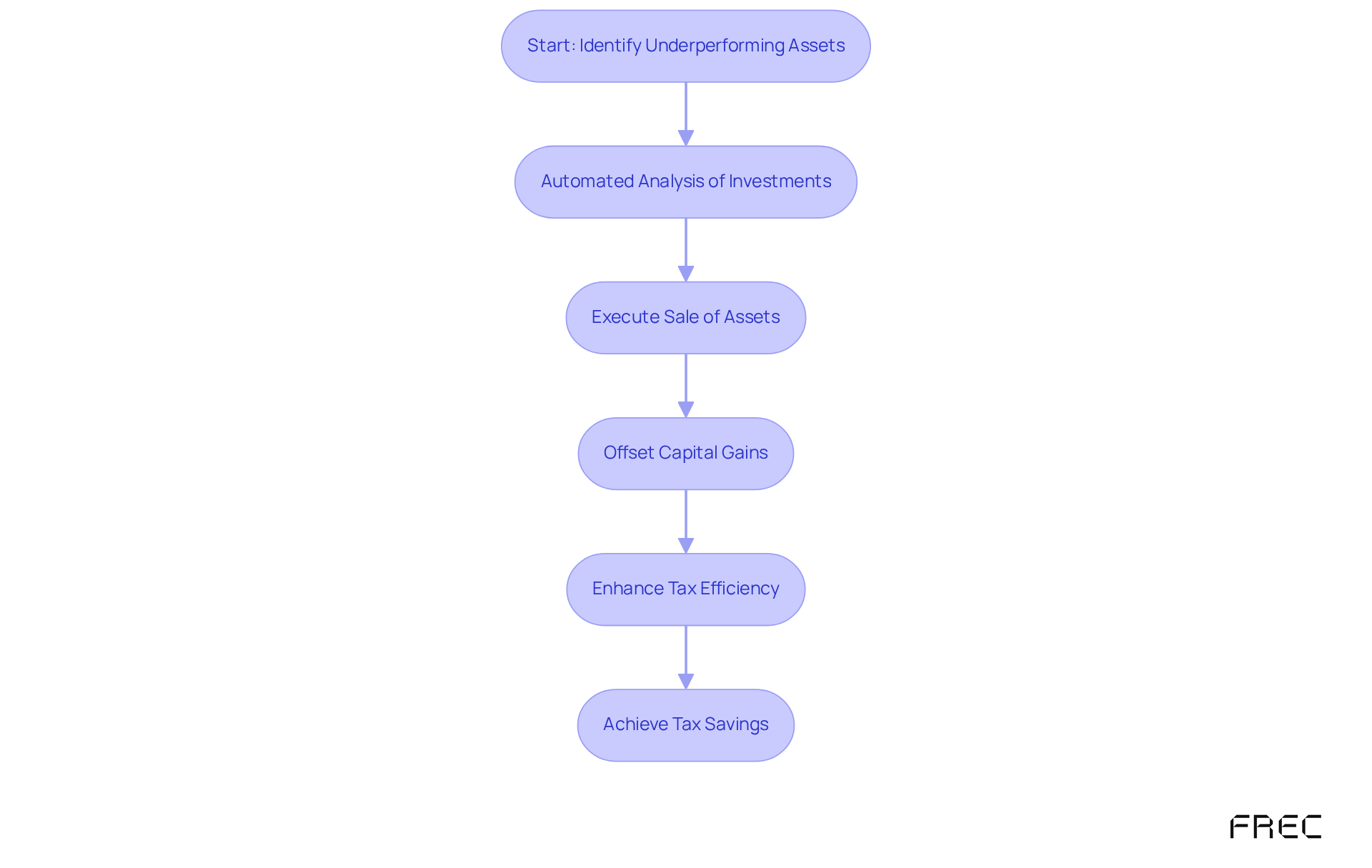

Automated tax loss harvesting enhances investment returns by utilizing advanced algorithms to identify and sell underperforming assets. This strategy effectively offsets capital gains and improves tax efficiency. In today's investment landscape, this innovative approach holds particular significance for DIY investors, offering a streamlined process for portfolio management. It ensures compliance with tax regulations, including the wash sale rule, which is crucial for maintaining tax efficiency. Ultimately, automated tax loss harvesting can lead to substantial tax savings, making it a compelling strategy for investors looking to optimize their portfolios.

Introduction

Automated tax loss harvesting is transforming the investment landscape, providing a sophisticated means to enhance tax efficiency and improve returns. By utilizing advanced algorithms, this strategy identifies underperforming assets for sale, enabling investors to offset capital gains and potentially achieve significant tax savings. Yet, as the market evolves, a pressing challenge persists: how can investors adeptly navigate the complexities of tax regulations while maximizing their financial outcomes? This article delves into seven key strategies for automated tax loss harvesting, designed to empower individuals in optimizing their investment portfolios and attaining greater financial success.

Frec: automated tax loss harvesting for enhanced tax efficiency

Automated tax loss harvesting is reshaping investment strategies by leveraging advanced algorithms that consistently track investments. This system employs automated tax loss harvesting to identify opportunities for selling underperforming assets, which effectively offsets capital gains and enhances overall . For investors seeking to optimize their strategies without relying on traditional financial advisors, this platform offers the potential for significant tax savings.

In today's market, where every advantage counts, recent advancements in AI technology further enhance this process. Real-time analysis and execution of trades can lead to improved investment returns. Financial experts point out that efficient tax benefit harvesting can yield substantial advantages, with projections suggesting that clients may save up to double the taxes compared to conventional methods.

As automated tax loss harvesting evolves, its integration into investment platforms is becoming essential for maximizing returns in a dynamic market environment. Investors should consider how these innovations can play a crucial role in their financial strategies, particularly as they navigate the complexities of tax implications.

Wealthfront: streamlined tax loss harvesting for DIY investors

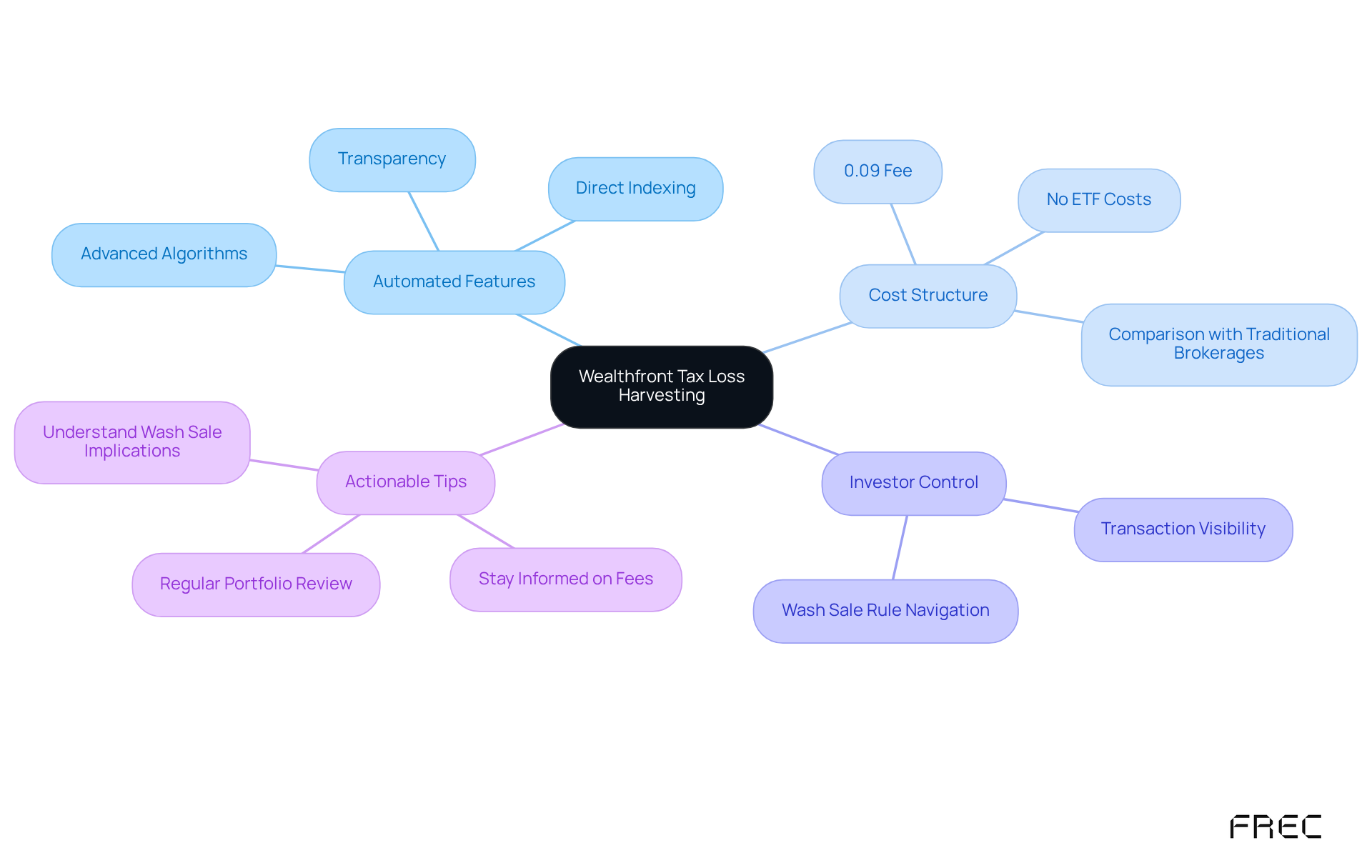

The platform provides an advanced automated tax loss harvesting feature that effectively identifies and sells underperforming investments to offset capital gains, similar to Wealthfront. Through its direct indexing solutions, the company provides tax-efficient strategies at an exceptionally low cost, starting at just 0.09% annually, or $18 per year for a $20,000 portfolio. This approach empowers investors to maximize their tax savings, potentially covering service costs up to 21 times over. The advanced algorithms analyze daily prospects across the entire portfolio, estimating that its direct indexing can capture declines equivalent to nearly 45% of your portfolio value over a decade. Unlike Wealthfront, which focuses on individual stocks, this firm's strategy incorporates a broader variety of stocks, enhancing the likelihood of achieving long-term tax savings. Furthermore, the platform ensures stakeholders can view every transaction executed on their behalf, detailing the resulting profits and losses for each stock. This level of transparency enables DIY investors to maintain control over their investments while benefiting from automated efficiency. As part of its tax-loss harvesting strategy, the firm adeptly navigates the wash sale rule by selling underperforming stocks and reallocating the proceeds to rebalance the portfolio, ensuring investors are not left with idle cash. After the 30-day wash sale period, investors can reinvest in the original stock, optimizing tax efficiency through strategic portfolio rebalancing. With no ETF costs and compared to traditional brokerages, which may charge up to 1.0%, this platform emerges as an appealing choice for investors seeking to enhance their overall returns in a competitive market.

Actionable Tips for DIY Investors:

- Regularly review your portfolio to pinpoint underperforming assets and leverage the platform's automated features for efficient tax loss harvesting.

- Stay informed about changes in investment requirements and fees to maximize your savings, taking advantage of the low-cost structure.

- Consider the implications of the wash sale rule when making investment decisions to maintain tax efficiency.

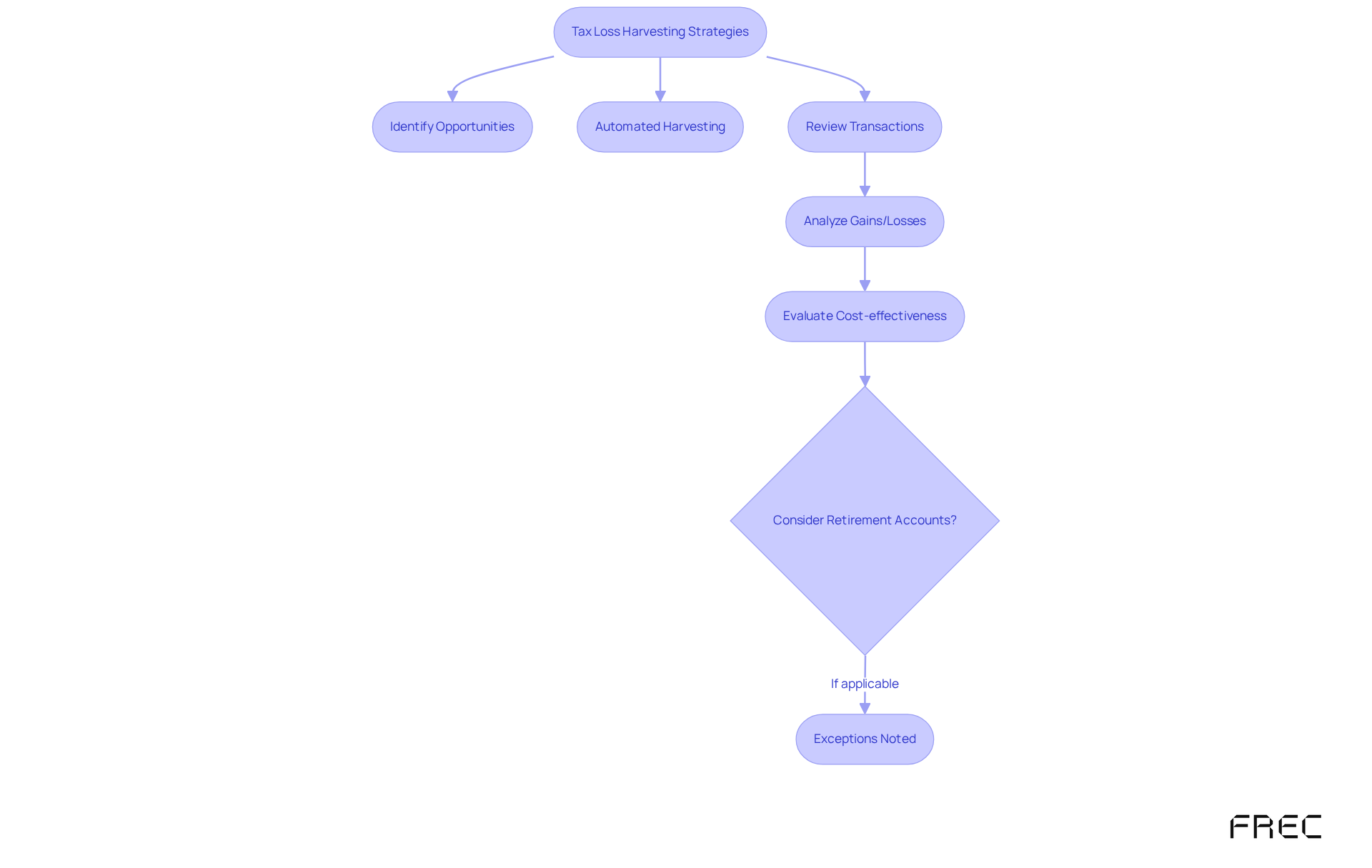

Vanguard: effective tax loss harvesting strategies to offset gains

Strategic tax harvesting plays a crucial role in mitigating capital gains, much like Vanguard's approach. However, Frec elevates this concept with its innovative direct indexing strategy, enabling a thorough daily assessment of opportunities across the entire portfolio. This capability empowers stakeholders to potentially recognize deficits that could reach nearly 45% of their portfolio value over a decade, thereby enhancing tax efficiency.

By implementing these strategies, individuals can significantly reduce their tax liabilities and enhance their after-tax returns with automated tax loss harvesting. Research indicates that efficient tax harvesting can yield considerable savings, with approximately 31% of gains from such strategies stemming from the ability to generate deficits, as noted by Vanguard.

Furthermore, the algorithms provide transparency by allowing stakeholders to review each transaction executed on their behalf, detailing the resulting gains and losses per stock. This level of detail is vital for DIY investors seeking to . Additionally, the analysis reveals that transaction costs associated with tax-loss harvesting are manageable, ranging from 0.5% to 1% of the harvested tax losses, making it a cost-effective alternative to traditional methods.

It is essential to note, however, that tax-loss harvesting may not be beneficial for tax-advantaged retirement accounts like Roth IRAs. By leveraging these strategies, individuals can refine their portfolios while navigating the complexities of tax implications. The organization's commitment to equipping individuals with automated tax loss harvesting techniques not only enhances their financial acumen but also positions them as a leader in the investment landscape.

As highlighted, 'Your CPA and financial planner can be your best ally when you’re emotional,' emphasizing the importance of strategic decision-making in tax-loss harvesting.

Betterment: accessible automated tax loss harvesting for individual investors

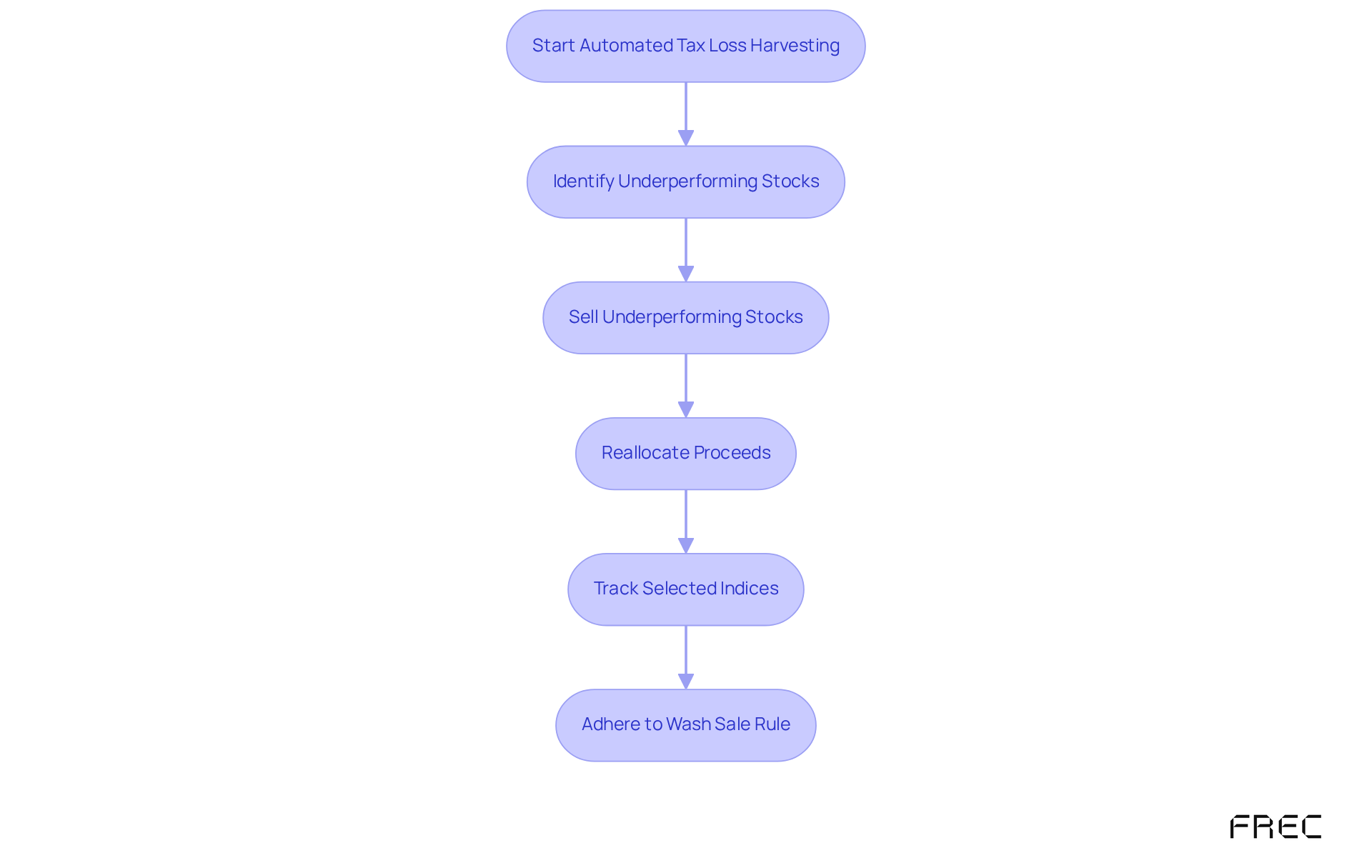

The platform introduces an innovative automated tax loss harvesting feature designed to strategically track investments and identify opportunities for minimizing losses. This capability allows individuals to enhance their tax efficiency effectively. Tailored for DIY investors who may lack extensive financial knowledge, it empowers them to engage in automated tax loss harvesting without requiring active portfolio management. By selling underperforming stocks and reallocating the proceeds, investors can track selected indices while adhering to the wash sale rule. This approach not only prevents cash from sitting idle but also supports reinvestment into stocks aligned with one’s objectives.

In contrast to other providers, this company offers competitively priced direct indexing solutions, starting as low as 0.09% annually, which can significantly boost tax savings. With no additional ETF costs, the platform enables investors to adopt that could potentially offset their expenses multiple times. To fully capitalize on these benefits, investors should regularly assess their investment strategies and consider how automated tax loss harvesting from Frec can integrate into their broader financial goals.

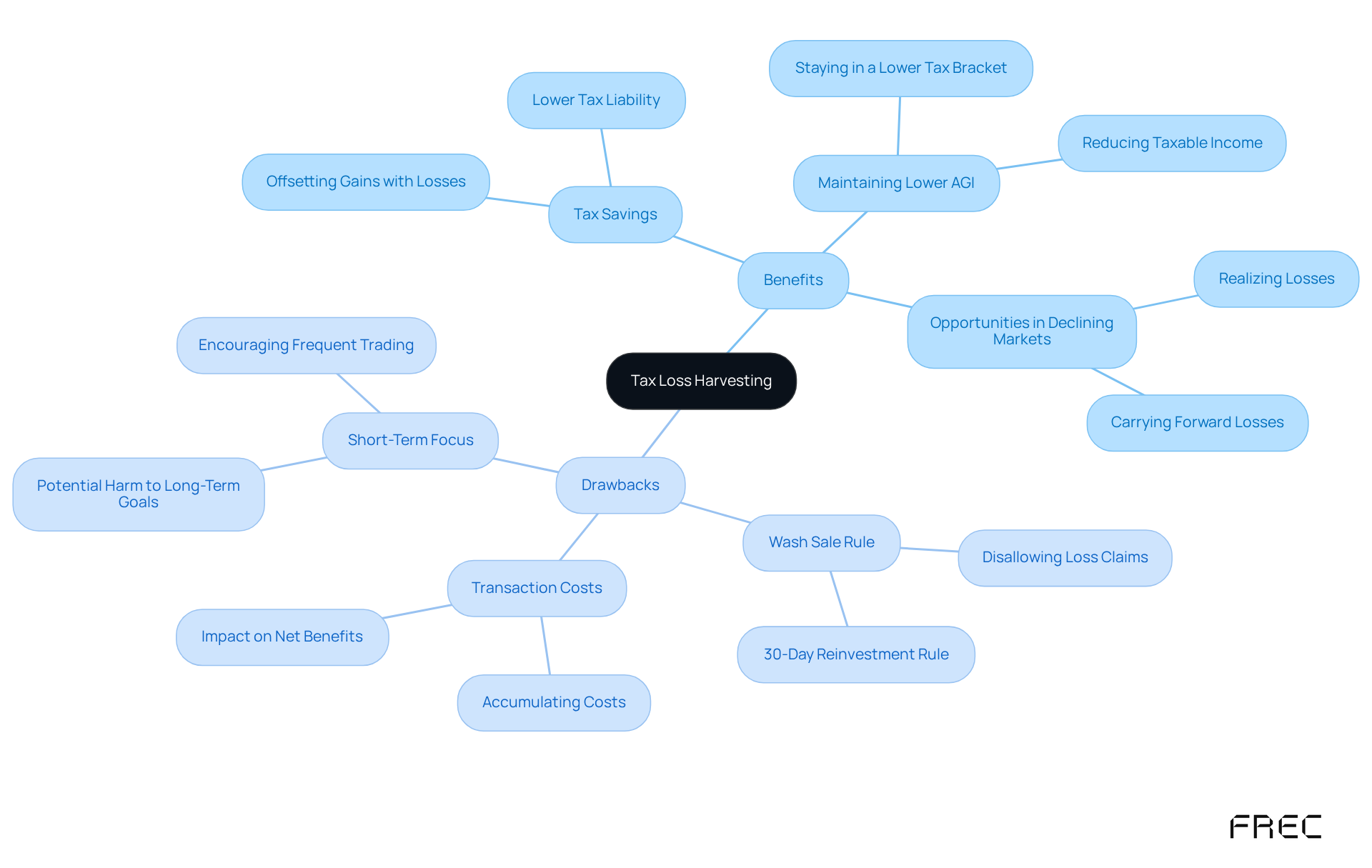

Investopedia: in-depth insights on tax loss harvesting benefits and drawbacks

Tax loss harvesting, particularly through automated tax loss harvesting, presents a compelling opportunity for individuals aiming to enhance their after-tax returns by strategically balancing capital gains with realized losses. This strategy is particularly beneficial for those in higher tax brackets, as it can lead to significant tax savings. However, investors must be aware of the risks involved. A prominent concern is the wash sale rule, which disallows claiming a deduction if the same or substantially identical security is repurchased within 30 days of the sale. If not managed carefully, this rule can undermine the intended tax advantages.

Additionally, transaction costs associated with selling investments can accumulate, potentially offsetting the benefits of tax harvesting. According to Frec's analysis, transaction costs from bid-ask spreads average around 2 basis points (bps) of trading volume, translating to less than 0.5% of capital reductions on average. Furthermore, trading fees imposed by regulators add approximately 1.7 bps for smaller accounts, decreasing significantly for larger accounts. This variation underscores the importance of account size in managing costs. Overall, anticipated transaction expenses can range from 0.5% to 1% of the tax deductions collected, which may considerably diminish net advantages, especially when incorporating automated tax loss harvesting in multiple transactions.

Investors should also recognize that while tax benefit harvesting can lower taxable income, it may inadvertently encourage a short-term focus that detracts from long-term investment goals. For example, selling an investment with a profit of $5,000 alongside another with a loss of $3,000 effectively reduces the taxable gain to $2,000, showcasing the strategy's potential effectiveness.

Real-world scenarios highlight the critical role of timing and market conditions in tax harvesting. A declining market can present favorable opportunities for realizing losses, allowing investors to carry forward surplus losses to future tax years. Moreover, tax harvesting can help individuals maintain a lower income tax bracket by reducing their adjusted gross income (AGI). Ultimately, understanding the complexities and risks of is essential for individuals aiming to improve their financial outcomes while maintaining a well-structured portfolio. As Jeff Christmann, Director of Tax Services, aptly states, "To get the most out of this strategy, it’s critical to approach it precisely, ensuring it complements your overall financial goals." To maximize the benefits of tax harvesting, individuals should consider integrating it with Direct Indexing features, offering a more tailored approach compared to traditional robo-advisors.

Merrill Edge: understanding the mechanics of tax loss harvesting

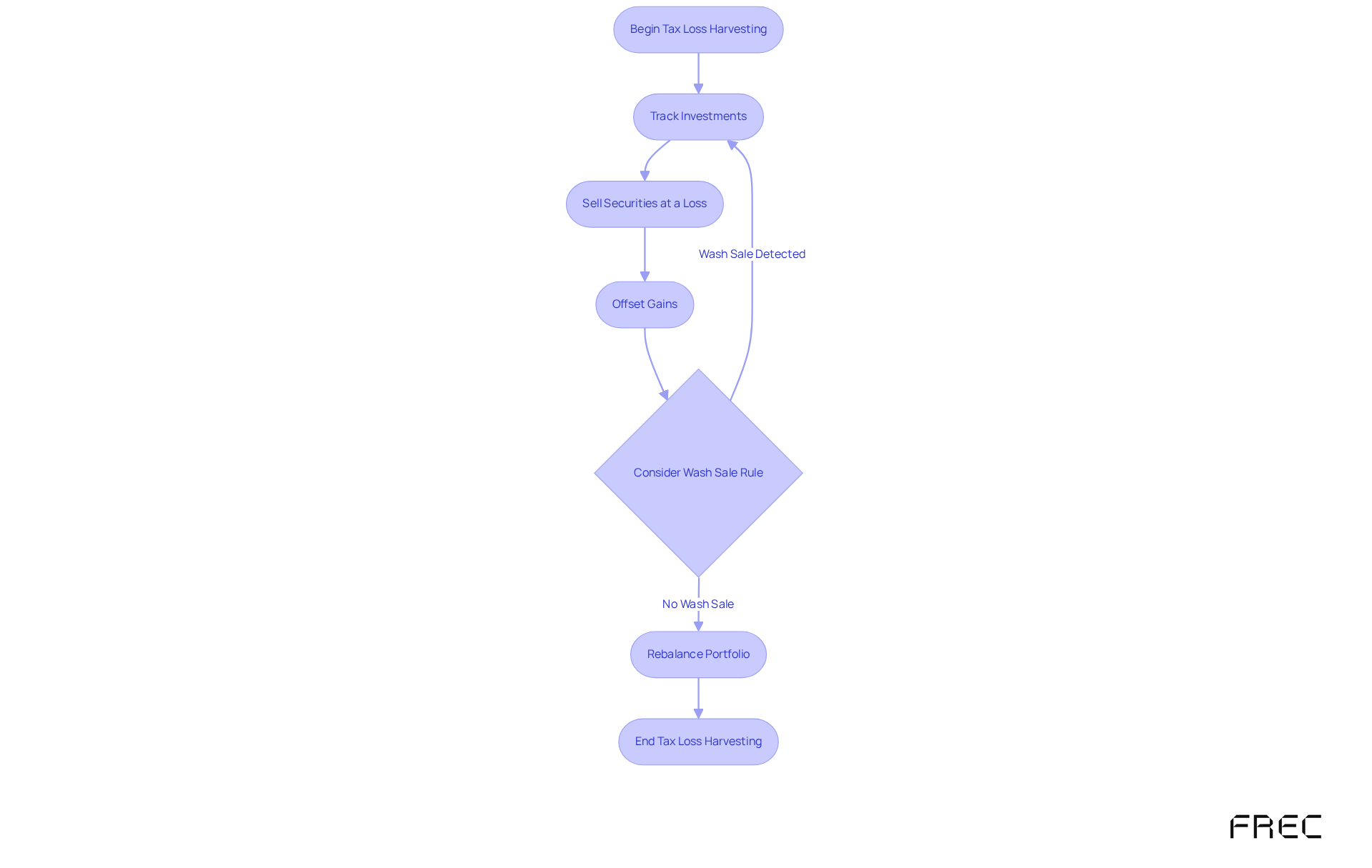

Frec elucidates the mechanics of automated tax loss harvesting, a strategy that allows individuals to sell securities at a loss to offset capital gains. This process demands meticulous tracking of investments and a solid understanding of the tax implications tied to each transaction. For instance, if an individual sells a stock for a $15,000 loss, they can apply that loss to counterbalance gains from other investments, effectively reducing their taxable income.

Financial advisors stress that mastering these mechanics can significantly enhance portfolio performance and minimize tax liabilities by utilizing automated tax loss harvesting. As one advisor noted, 'By strategically balancing gains with setbacks, you can lessen your tax obligation and create flexibility for future tax years.'

It is essential for those involved in finance to be aware of the 'wash sale rule,' which disallows tax breaks for selling assets at a loss and then repurchasing substantially identical assets within 30 days.

Frec's approach not only promotes tax efficiency but also utilizes automated tax loss harvesting, enabling individuals to maintain a well-organized portfolio while navigating market fluctuations. By utilizing proceeds from sold stocks to rebalance their portfolios and invest in algorithmically selected alternatives, individuals can optimize their tax outcomes.

Furthermore, individuals can offset up to $3,000 of ordinary income with capital losses, further illustrating the financial implications of tax loss harvesting. Understanding the nuances of automated tax loss harvesting, including the need for systems to swiftly identify tax lots, is crucial for individuals aiming to in 2025 and beyond.

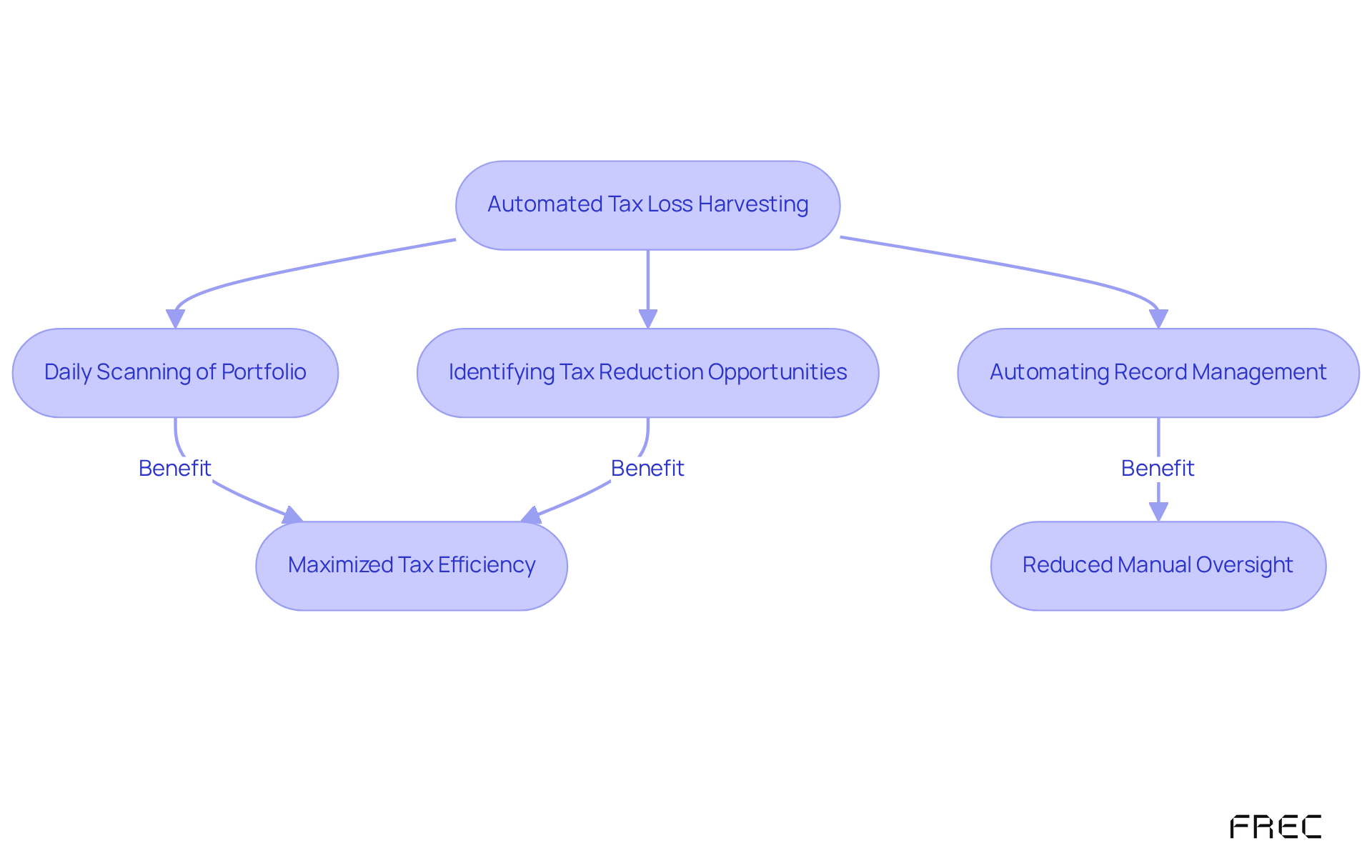

Nitrogen Wealth: automated solutions for tax loss harvesting

The rise of advanced technology in automated tax loss harvesting has transformed how investors manage their portfolios. This innovation enables investors to effectively identify and capitalize on opportunities for tax reductions. Daily scanning of the entire directly-indexed portfolio by automated tax loss harvesting algorithms offers greater potential for tax savings. Such a sophisticated approach simplifies the complex task of managing records for tax lots, which is essential for efficient asset harvesting.

By implementing automated tax loss harvesting, the platform automates this process to empower tech-savvy investors to enhance their tax savings while remaining aligned with their broader investment strategies. With direct indexing fees as low as 0.09% annually, Frec’s platform not only minimizes costs but also , offering potential savings that could pay for itself multiple times.

As industry specialists note, 'Technology can assist individuals in improving their returns through automated tax loss harvesting by continuously tracking their portfolios for tax-loss harvesting chances.' This capability streamlines the investment process and maximizes potential returns, positioning it as an essential tool for investors aiming to optimize their financial outcomes in 2025 and beyond.

Moreover, the shift towards automated tax loss harvesting marks a significant evolution in portfolio management, enabling investors to navigate market fluctuations seamlessly without the burden of constant manual oversight. In comparison, while Wealthfront provides daily tax-loss harvesting, it is restricted to individual stocks within the S&P 500 and US Total Market, making Frec’s broader approach more advantageous.

Conclusion

Automated tax loss harvesting is transforming investment strategies by equipping investors with tools that enhance tax efficiency and optimize returns. By leveraging advanced algorithms and real-time analysis, investors can pinpoint and sell underperforming assets, effectively offsetting capital gains and maximizing their overall financial performance. This innovative approach not only streamlines the investment process but also empowers individuals to take control of their financial futures without relying on traditional financial advisors.

Key strategies and platforms such as:

- Frec

- Wealthfront

- Vanguard

- Betterment

- Nitrogen Wealth

illustrate unique offerings in automated tax loss harvesting. These platforms provide a spectrum of features, from low-cost direct indexing solutions to comprehensive investment tracking, enabling investors to capitalize on tax savings while maintaining transparency and control over their portfolios. Understanding the wash sale rule and the potential transaction costs associated with tax loss harvesting is essential, underscoring the need for strategic planning.

Embracing automated tax loss harvesting represents a significant opportunity for investors to enhance their after-tax returns and navigate the complexities of capital gains. As technology continues to evolve, utilizing these automated solutions will be increasingly vital for optimizing investment strategies in a dynamic market landscape. Investors are encouraged to explore these tools and integrate tax loss harvesting into their broader financial goals, ensuring they remain well-positioned to maximize their investment outcomes in the years ahead.

Frequently Asked Questions

What is automated tax loss harvesting?

Automated tax loss harvesting is a strategy that uses advanced algorithms to track investments and identify opportunities for selling underperforming assets. This helps offset capital gains and enhances overall tax efficiency for investors.

How does automated tax loss harvesting benefit investors?

It allows investors to optimize their investment strategies without relying on traditional financial advisors, potentially leading to significant tax savings by effectively managing capital gains.

What recent advancements have improved automated tax loss harvesting?

Recent advancements in AI technology enable real-time analysis and execution of trades, which can improve investment returns and enhance the efficiency of tax benefit harvesting.

How much can clients potentially save using automated tax loss harvesting compared to traditional methods?

Projections suggest that clients may save up to double the taxes compared to conventional methods through efficient tax benefit harvesting.

What is Wealthfront's approach to tax loss harvesting for DIY investors?

Wealthfront offers an automated tax loss harvesting feature that identifies and sells underperforming investments to offset capital gains, providing tax-efficient strategies at a low cost.

What are the costs associated with Wealthfront's tax loss harvesting service?

Wealthfront's services start at just 0.09% annually, or $18 per year for a $20,000 portfolio.

How does the tax loss harvesting strategy differ between Wealthfront and other platforms?

Unlike Wealthfront, which focuses on individual stocks, other platforms incorporate a broader variety of stocks, which can enhance the likelihood of achieving long-term tax savings.

What transparency does the platform provide to DIY investors?

The platform allows stakeholders to view every transaction executed on their behalf, detailing the resulting profits and losses for each stock, thereby maintaining investor control.

How does the platform navigate the wash sale rule?

The platform sells underperforming stocks and reallocates the proceeds to rebalance the portfolio, ensuring that investors are not left with idle cash. After the 30-day wash sale period, they can reinvest in the original stock.

What are the advantages of using this platform compared to traditional brokerages?

The platform has no ETF costs and lower management fees compared to traditional brokerages, which may charge up to 1.0%, making it an appealing choice for investors seeking to enhance their overall returns.

List of Sources

- Frec: automated tax loss harvesting for enhanced tax efficiency

- How Wealthfront’s Tax-Loss Harvesting Performed in 2024 (https://wealthfront.com/blog/tax-loss-harvesting-results-2024)

- Frec - Index investing that gets you more (https://frec.com)

- Automating Tax-Loss Harvesting with AI Tools: A Game-Changer for Investors (https://techbullion.com/automating-tax-loss-harvesting-with-ai-tools-a-game-changer-for-investors)

- Top Tax Loss Harvesting Strategies for HNW Investors 2025 (https://commonsllc.com/insights/tax-loss-harvesting-strategies)

- Wealthfront: streamlined tax loss harvesting for DIY investors

- Kitces, Wealthfront trade punches over online tax-loss-harvesting feature (https://investmentnews.com/industry-news/kitces-wealthfront-trade-punches-over-online-tax-loss-harvesting-feature/56293)

- Wealthfront Eliminates $100k Minimum For Tax-Loss Harvesting (https://wealthmanagement.com/high-net-worth/wealthfront-eliminates-100k-minimum-for-tax-loss-harvesting)

- Wealthfront Brings Tax Efficiency to Index-Based Investing with New S&P 500 Direct Portfolio (https://prnewswire.com/news-releases/wealthfront-brings-tax-efficiency-to-index-based-investing-with-new-sp-500-direct-portfolio-302333283.html)

- Wealthfront Review 2025 | Bankrate (https://bankrate.com/investing/roboadvisor-reviews/wealthfront)

- 5 Best Investment Apps for Beginners in 2025 - WTOP News (https://wtop.com/news/2025/01/5-best-investment-apps-for-beginners-in-2025)

- Vanguard: effective tax loss harvesting strategies to offset gains

- Investment Losses in 2024? Vanguard Emphasizes the Value of Tax-Loss Harvesting Strategy (https://smartasset.com/investing/vanguard-value-tax-loss-harvesting)

- Vanguard Evaluates Tax-Loss Harvesting Strategy to Offset Capital Gains: Is It Worth It? (https://finance.yahoo.com/news/vanguard-evaluates-tax-loss-harvesting-145933888.html)

- Vanguard finds tax-loss harvesting is key to advisor value (https://financial-planning.com/news/vanguard-advisors-alpha-study-cites-tax-loss-harvesting)

- With stock prices falling, consider ‘tax-loss harvesting’ to stay invested (https://inquirer.com/business/small-business/stock-market-tax-loss-harvesting-investment-20250318.html)

- Betterment: accessible automated tax loss harvesting for individual investors

- SEC Fines Betterment $9M for Not Revealing Tax-Loss Harvesting Errors (https://wealthmanagement.com/regulation-compliance/sec-fines-betterment-9m-for-not-revealing-tax-loss-harvesting-errors)

- Betterment Pays SEC $9M for Misstatements Regarding Tax Loss Harvesting | PLANADVISER (https://planadviser.com/betterment-pays-sec-9m-misstatements-regarding-tax-loss-harvesting)

- SEC.gov | SEC Charges Investment Adviser Betterment for Misstatements Concerning Tax Loss Harvesting Service (https://sec.gov/newsroom/press-releases/2023-80)

- Betterment Review 2025 (https://wsj.com/buyside/personal-finance/financial-advisors/betterment-review?gaa_at=eafs&gaa_n=ASWzDAiLjNFTFi6k2Xd7NIGwrxLWYUI7BXPhQDN9bjCc_0IVKOZOWlUtkMeq&gaa_ts=68a78059&gaa_sig=khycAGQakNl225tq97ZktUk9WXBFxa8ryCpNLWY2QxqbNud8cg0I5J89JMUHyhg-rz1pgRMV2uHNeQGK5hFV6g%3D%3D)

- Betterment expands advisor solutions range with Rowboat acquisition (https://privatebankerinternational.com/news/betterment-advisor-solutions-rowboat)

- Investopedia: in-depth insights on tax loss harvesting benefits and drawbacks

- Current market conditions present opportunities for tax-loss harvesting (https://wolterskluwer.com/en/expert-insights/current-market-conditions-present-opportunities-for-tax-loss-harvesting)

- Year-End Tax Planning: Maximizing Tax Savings with Tax Loss Harvesting - Bryn Mawr Trust Wealth Management (https://bmt.com/news-insights-events/year-end-tax-planning-maximizing-tax-savings-with-tax-loss-harvesting)

- Tax Loss Harvesting - Asset Strategy (https://assetstrategy.com/tax-loss-harvesting-2024-blog)

- What to know about tax loss harvesting (https://synovus.com/personal/resource-center/financial-newsletters/2022/march/what-to-know-about-tax-loss-harvesting)

- Merrill Edge: understanding the mechanics of tax loss harvesting

- Merrill Unveils Tax-Loss Harvesting Reports (https://fa-mag.com/news/merrill-lynch-unveils-tax-loss-harvesting-reports-79294.html)

- Year-End Tax Planning: Maximizing Tax Savings with Tax Loss Harvesting - Bryn Mawr Trust Wealth Management (https://bmt.com/news-insights-events/year-end-tax-planning-maximizing-tax-savings-with-tax-loss-harvesting)

- This tax strategy is a 'silver lining' amid tariff volatility, advisor says. Here's how to use it (https://cnbc.com/2025/04/08/tax-loss-harvesting-tariff-volatility.html)

- Tax-loss harvesting: How can it lower your tax bill? (https://invesco.com/us/en/insights/tax-loss-harvesting-could-lower-your-tax-bill.html)

- Tax-Loss Harvesting Can Work Year-Round for Investors—Here’s How | Morgan Stanley (https://morganstanley.com/articles/tax-loss-harvesting)

- Nitrogen Wealth: automated solutions for tax loss harvesting

- How cutting edge technology can enhance your wealth with tax savings | J.P. Morgan Private Bank U.S. (https://privatebank.jpmorgan.com/nam/en/insights/markets-and-investing/how-cutting-edge-technology-can-enhance-your-wealth-with-tax-savings)

- Technology Unleashes the Power of Year-Round Tax-Loss Harvesting (https://kiplinger.com/taxes/tax-planning/technology-unleashes-power-of-year-round-tax-loss-harvesting)

- Wealth Management News: June 2025 (https://nitrogenwealth.com/blog/wealth-management-news-june-2025)

- Fintech bytes: Altruist launches new subscription service for RIA custody (https://investmentnews.com/fintech/fintech-bytes-altruist-launches-new-subscription-service-for-ria-custody/261584)